Classification

Welcome to My Page.

ML-Classification

📅 Date: April 02, 2024

🔍 Domain: Banking

📊 Topic: Predictive Modeling for Telemarketing Campaigns

🔗 View Full Project Files

🧠 Abstract

This project leverages supervised machine learning classification techniques to predict whether a customer will subscribe to a term deposit during a Portuguese bank’s telemarketing campaign. Using publicly available data from the UCI Machine Learning Repository, the aim is to explore how decision-making can be optimized using AI models like Random Forest, Decision Trees, and Boosted Models.

Key benefits for the bank include:

- Enhanced targeting of high-potential clients

- Improved marketing efficiency and ROI

- Actionable insights on customer behavior

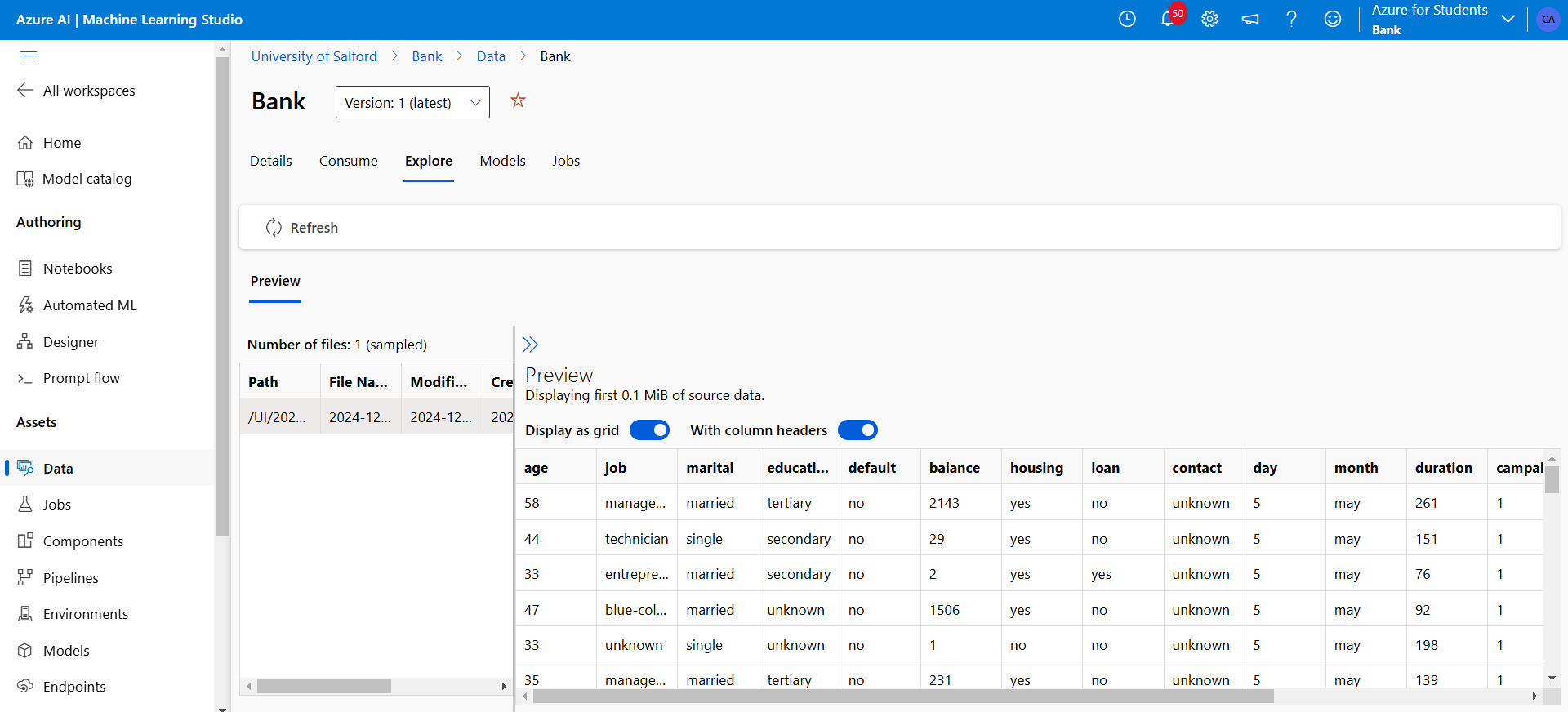

📂 Dataset Overview

- Source: UCI Bank Marketing Dataset

- Features: 17 (Categorical & Numerical)

- Target: Binary (

yesorno) — whether a customer subscribed

📈 Exploratory Data Analysis

The following visuals were generated:

- Subscription Distribution

- Age vs. Subscription

- Contact Month vs. Success Rate

- Loan Status vs. Subscription

- Correlation Heatmap

- KDE and Histograms for Continuous Features

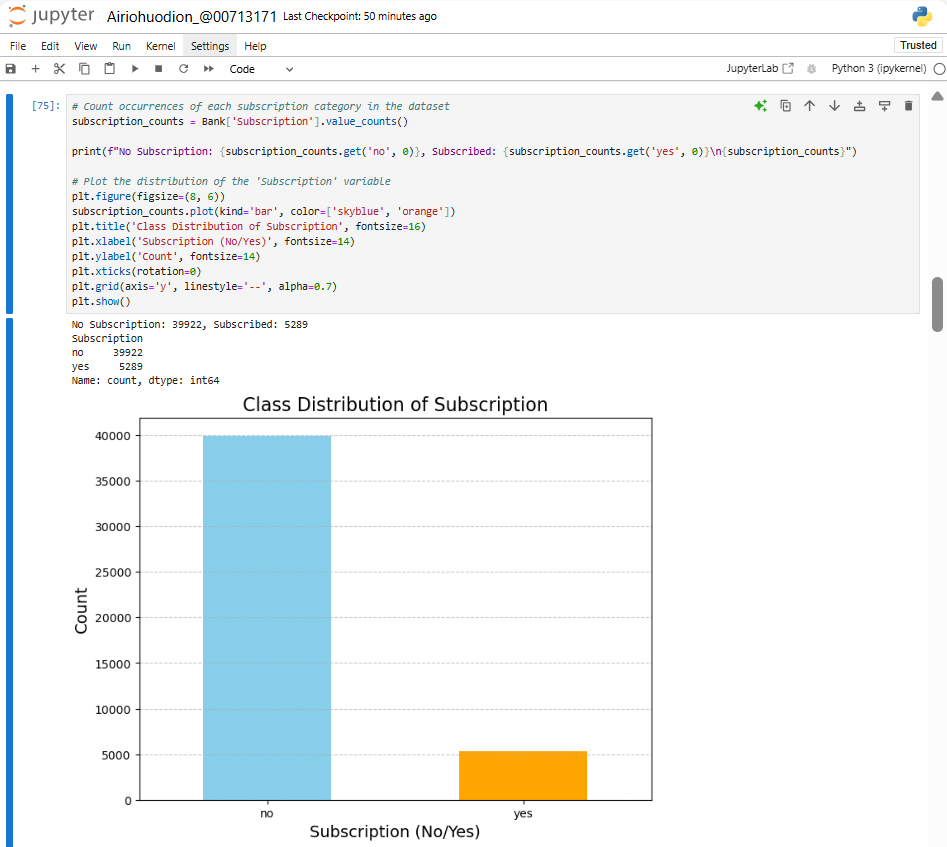

Figure 1: Showing the values for No and Yes class on (subscription) target variable.

Figure 1: Showing the values for No and Yes class on (subscription) target variable.

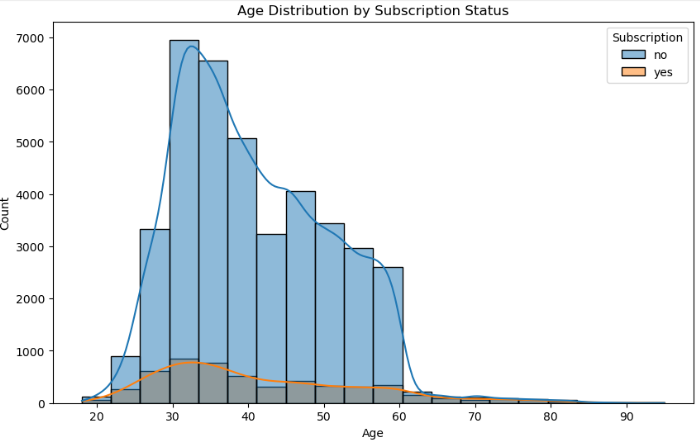

Figure 2: It shows that persons within 30 years subscribe the most.

Figure 2: It shows that persons within 30 years subscribe the most.

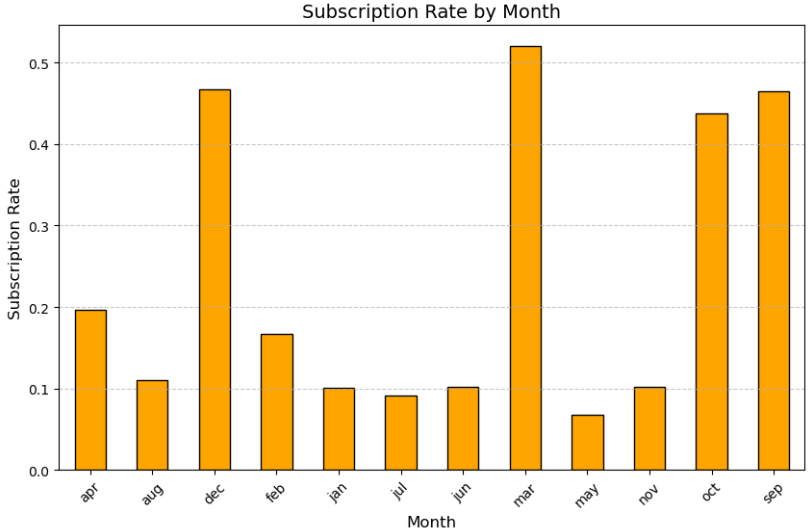

Figure 3: This code uses a bar chart with stylised formatting to compute and display subscription rates by month. The month of march has highest subscription rates.

Figure 3: This code uses a bar chart with stylised formatting to compute and display subscription rates by month. The month of march has highest subscription rates.

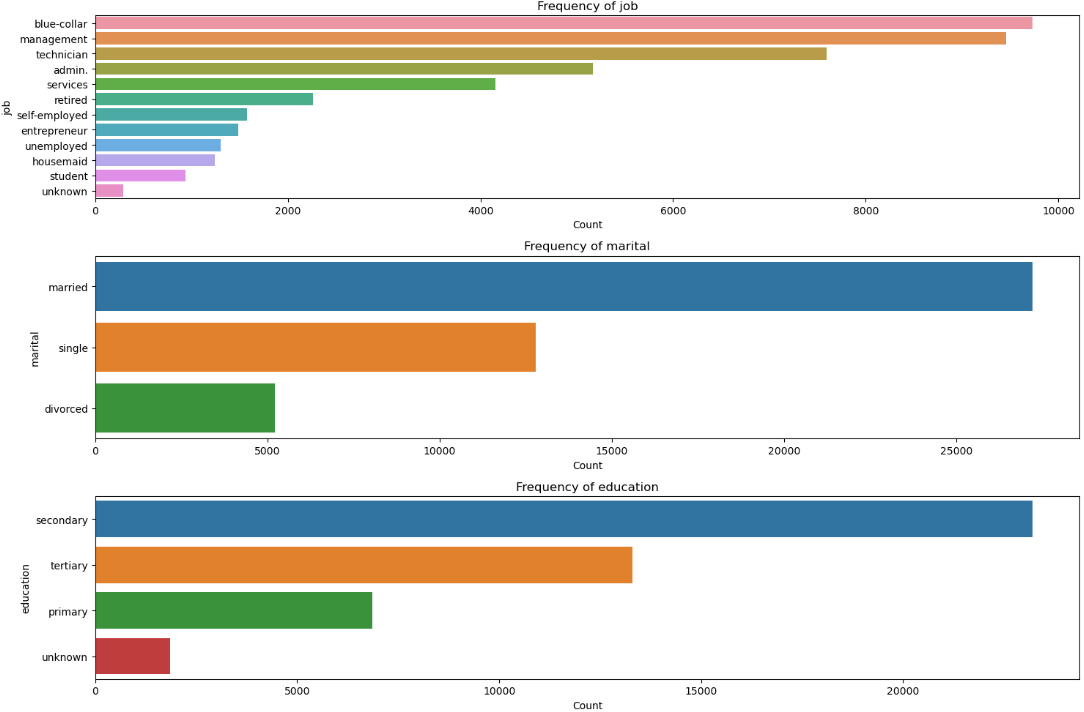

Figure 4:The categorical features analysis shows histograms and KDE plots of the distribution of continuous features.

Figure 4:The categorical features analysis shows histograms and KDE plots of the distribution of continuous features.

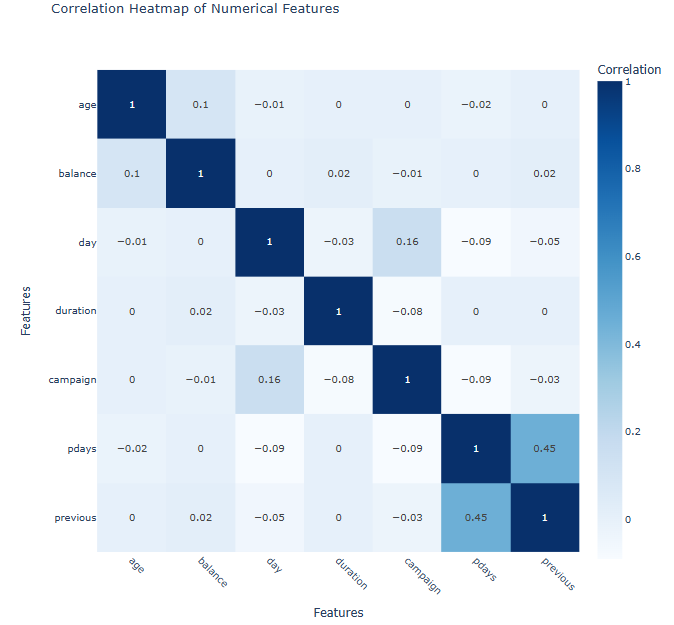

Figure 5:Calculated numerical features for correlations, visualising and to view them interactively for insights into relationships.

Figure 5:Calculated numerical features for correlations, visualising and to view them interactively for insights into relationships.

🔑 Variables

- Demographics:

age,job,education,marital status - Campaign Details:

call duration,contact month,number of contacts - Socio-Economic Indicators:

consumer confidence index,employment rate,interest rate

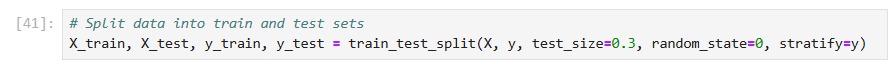

🧹 Data Preprocessing

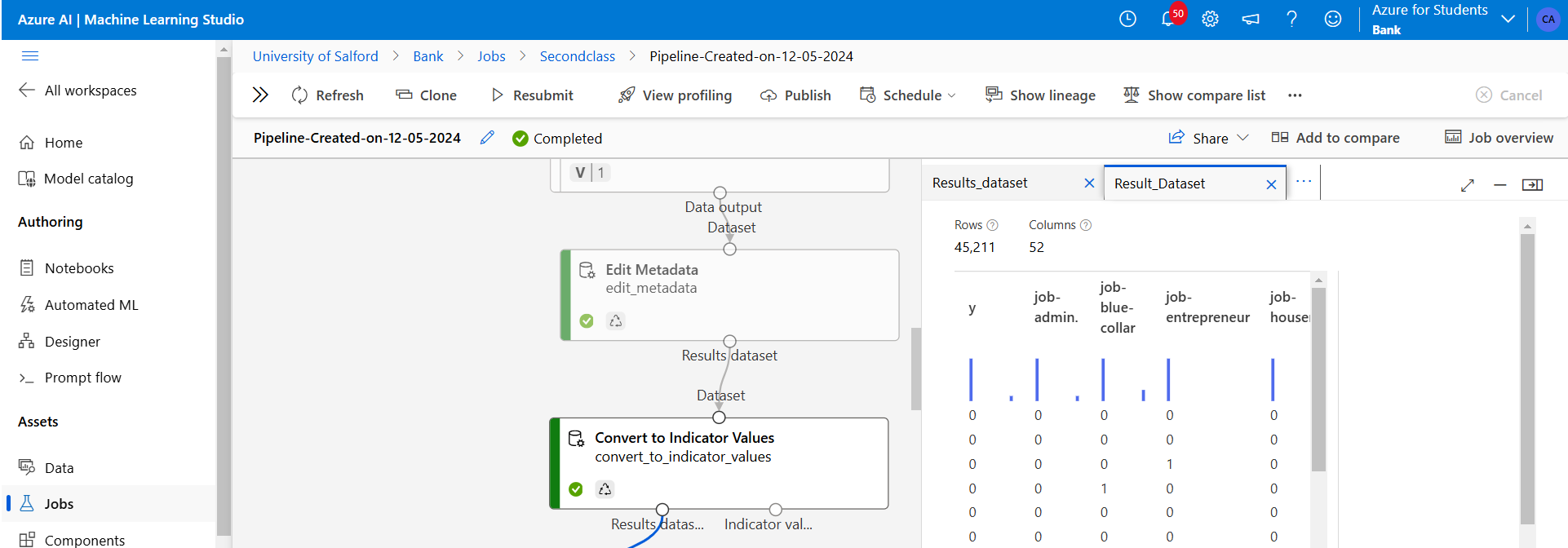

- Categorical Encoding with One-Hot Encoding

- Standardization with StandardScaler

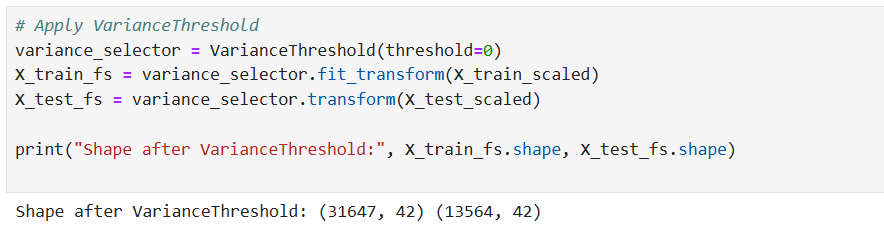

- Feature selection via RFECV

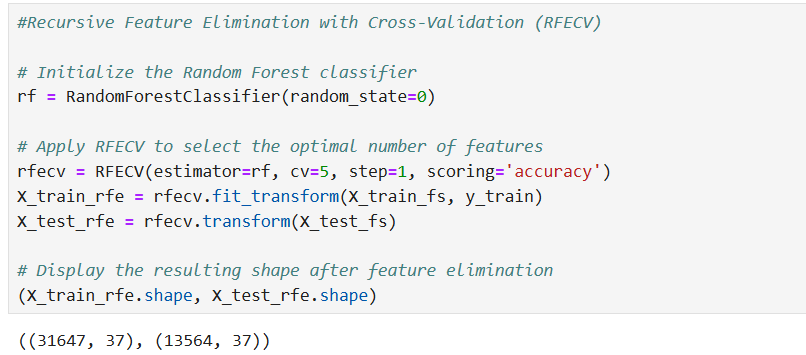

- Class imbalance handled using Random UnderSampling and SMOTE

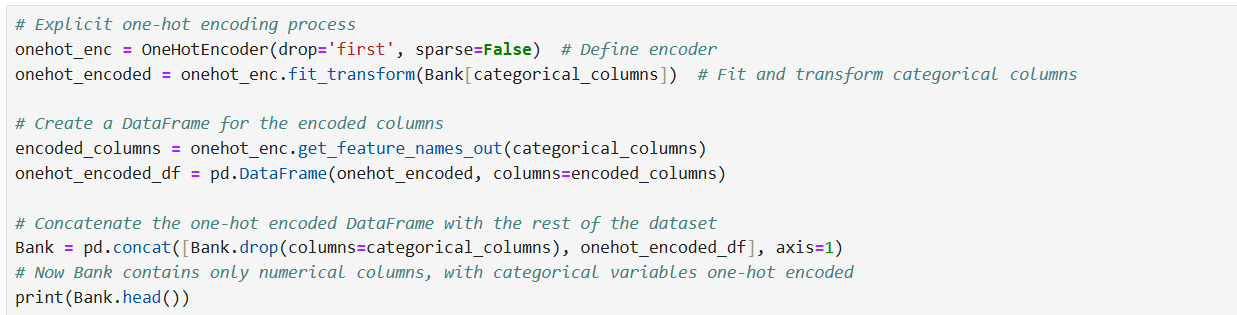

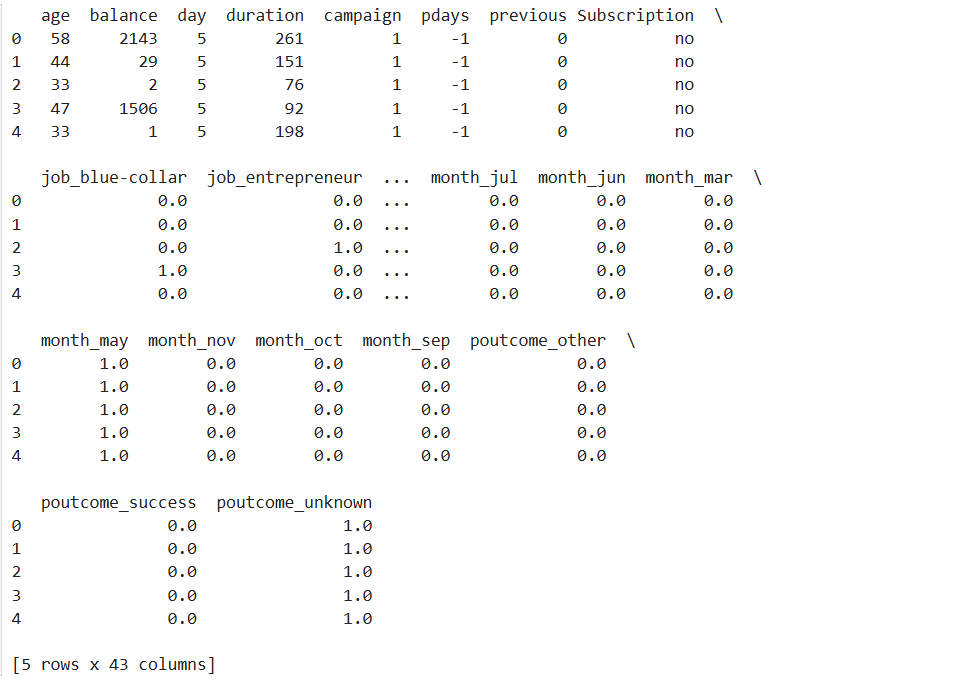

Figure 6: Firstly I removed the target variable and deleted the dummy class variables I used for visualisation. The dataset categorical variables are fully encoded as one-hot-encoded features and ready for modelling.

Figure 6: Firstly I removed the target variable and deleted the dummy class variables I used for visualisation. The dataset categorical variables are fully encoded as one-hot-encoded features and ready for modelling.

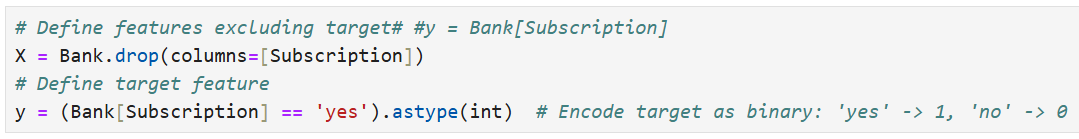

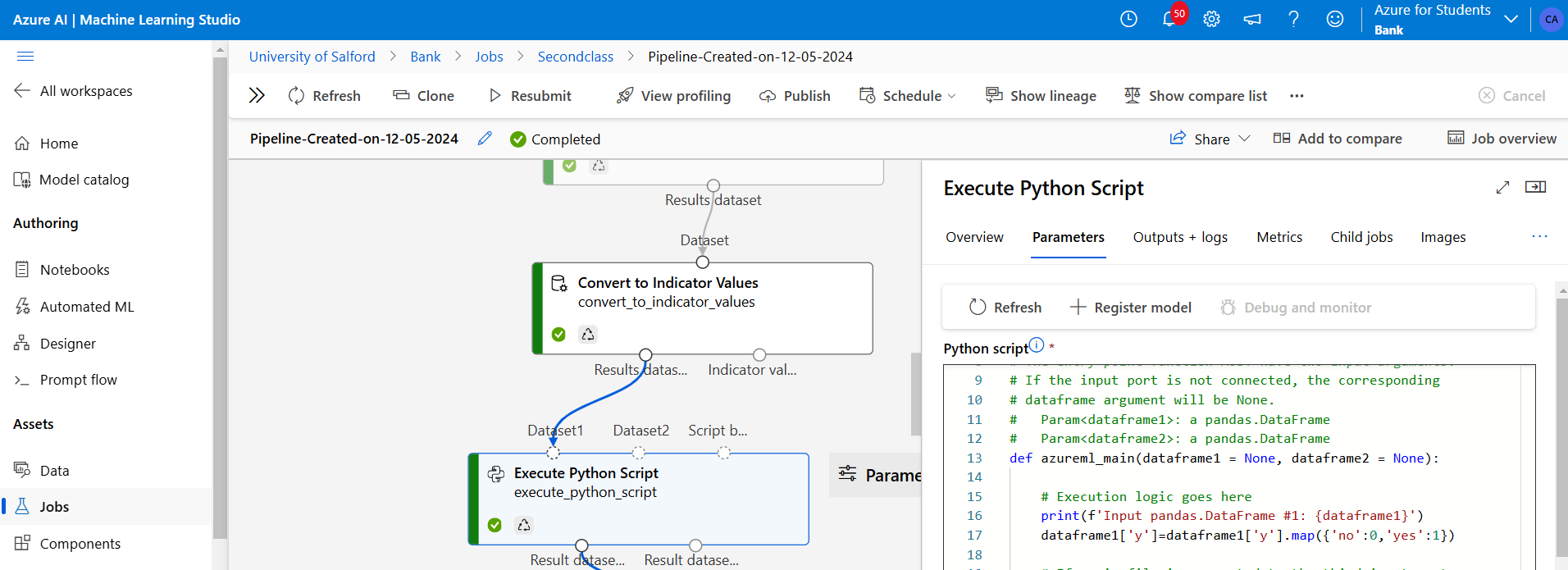

Figure 7: Above I defined my features and target, I then converted my target “y” from (yes to 1 and no to 0) Splitting all feature into ‘X’ and target variable to ‘y’

Figure 7: Above I defined my features and target, I then converted my target “y” from (yes to 1 and no to 0) Splitting all feature into ‘X’ and target variable to ‘y’

Figure 8: From the result, no features were removed this means all training and testing sets had variance above the threshold.

Figure 8: From the result, no features were removed this means all training and testing sets had variance above the threshold.

Figure 9: The result “((31647, 37), (13564, 37))” shows that the feature selection process reduced the dataset from 42 to 37 features. This means 5 features were identified as less important and removed, leaving a more focused set of features for the model. This will make the model more efficient and potentially improve its performance by removing irrelevant or redundant information.

Figure 9: The result “((31647, 37), (13564, 37))” shows that the feature selection process reduced the dataset from 42 to 37 features. This means 5 features were identified as less important and removed, leaving a more focused set of features for the model. This will make the model more efficient and potentially improve its performance by removing irrelevant or redundant information.

Figure 10: Addressing class imbalance by applying Random Undersampling, balancing the dataset target variable for improved model fairness.

Figure 10: Addressing class imbalance by applying Random Undersampling, balancing the dataset target variable for improved model fairness.

🤖 Models Implemented

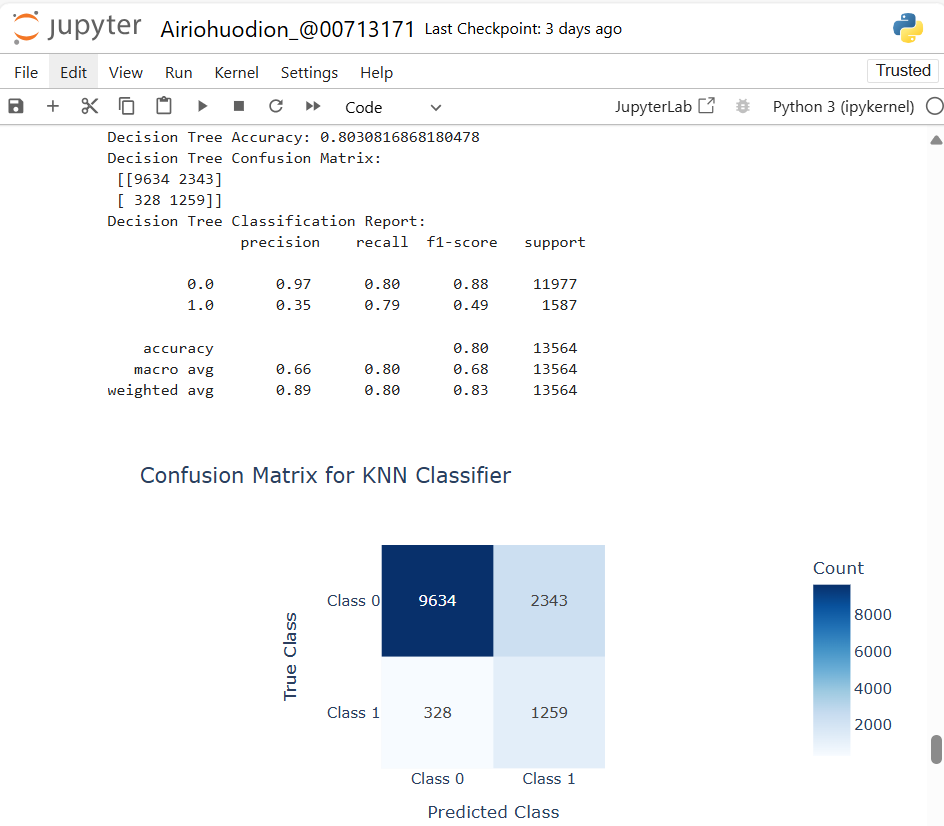

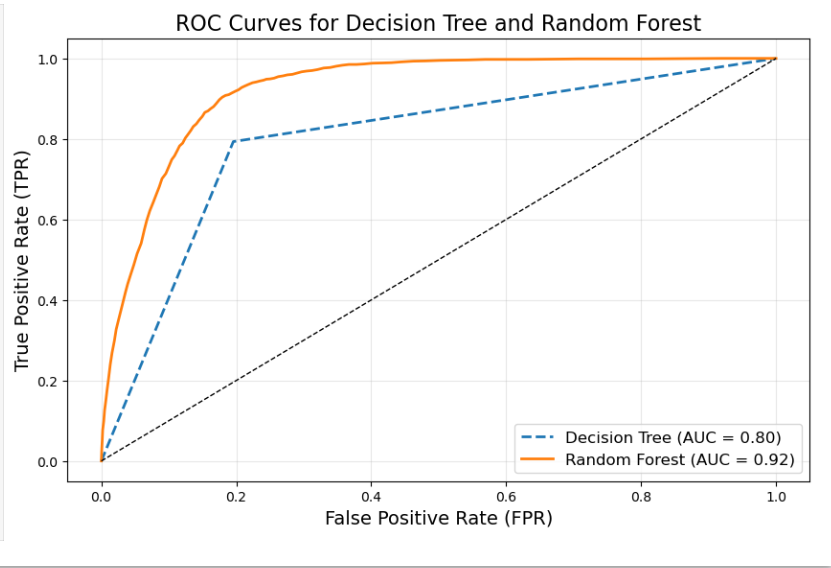

1️⃣ Decision Tree Classifier

- Accuracy: 80.3%

- Issues: Poor recall on the minority class

- Tuned Accuracy: 82.3%

Figure 11: The Decision Tree Classification result reports 80% accuracy and the confusion matrix is as follows.

Figure 11: The Decision Tree Classification result reports 80% accuracy and the confusion matrix is as follows.

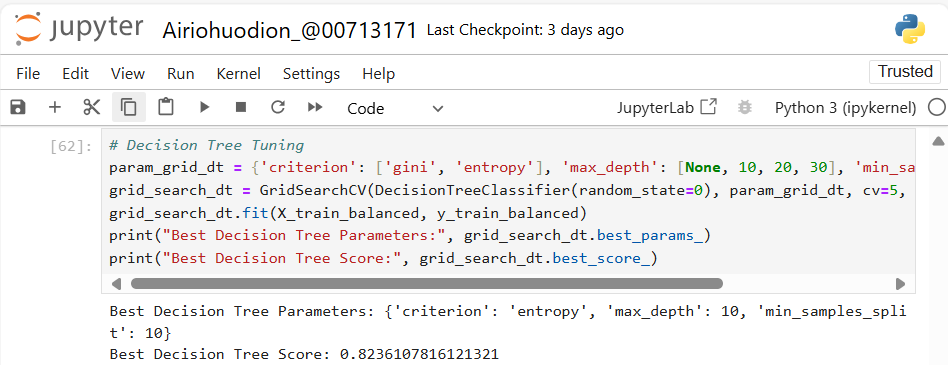

Figure 12: The best cross-validated accuracy achieved with these parameters is 82.36%, indicating improved performance compared to the untuned model. This configuration balances complexity and predictive accuracy, making it more robust.

Figure 12: The best cross-validated accuracy achieved with these parameters is 82.36%, indicating improved performance compared to the untuned model. This configuration balances complexity and predictive accuracy, making it more robust.

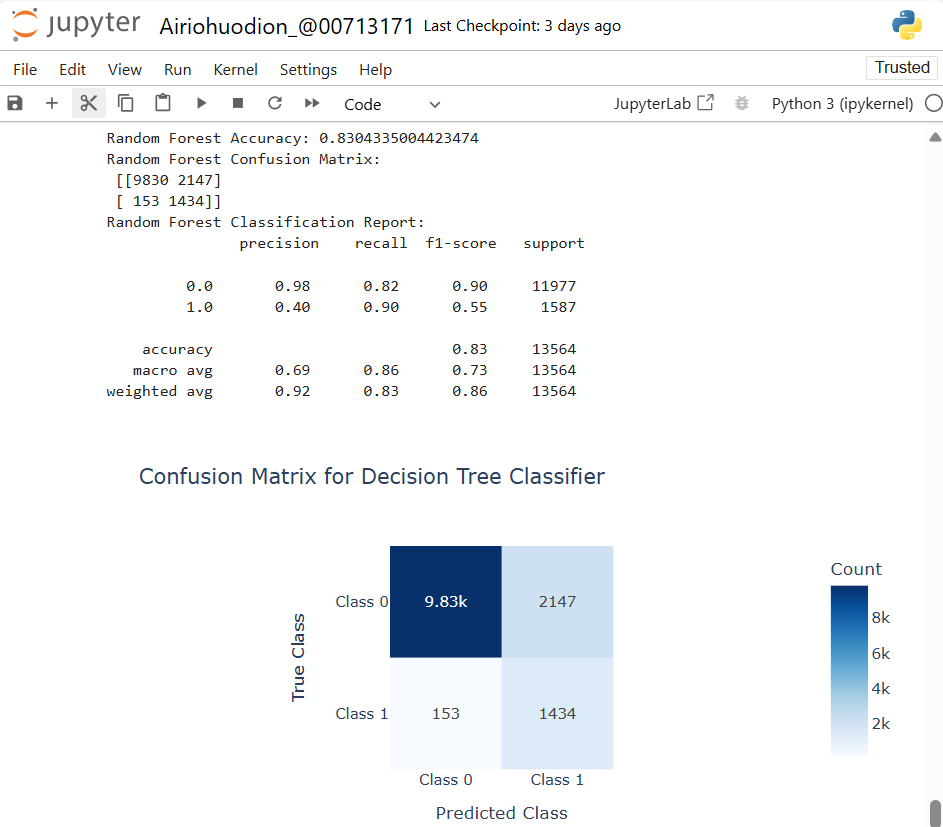

2️⃣ Random Forest Classifier

- Accuracy: 83.0%

- Tuned Accuracy: 86.1%

- Strengths: Strong performance on minority class, better generalization

Figure 13: The Random Forest classifier achieved an accuracy of 83.04%. The Random Forest performs better on minority Class 1 compared to Decision Tree but still struggles with precision, indicating room for improvement in predicting positive cases.

Figure 13: The Random Forest classifier achieved an accuracy of 83.04%. The Random Forest performs better on minority Class 1 compared to Decision Tree but still struggles with precision, indicating room for improvement in predicting positive cases.

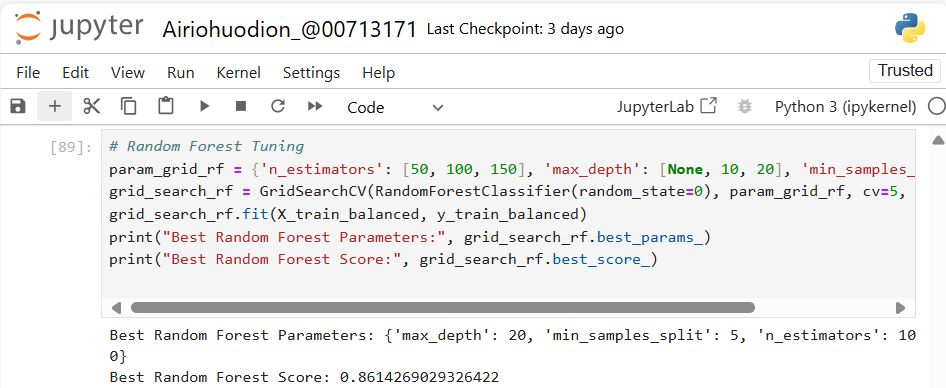

Figure 14: The best cross-validated accuracy achieved is 86.14%, demonstrating improved performance with the tuned parameters. This setup balances complexity and predictive power for robust model performance.

Figure 14: The best cross-validated accuracy achieved is 86.14%, demonstrating improved performance with the tuned parameters. This setup balances complexity and predictive power for robust model performance.

Figure 15: The outcome above distinguishes the positive and negative class using “Area Under the Curve(AUC)”

Figure 15: The outcome above distinguishes the positive and negative class using “Area Under the Curve(AUC)”

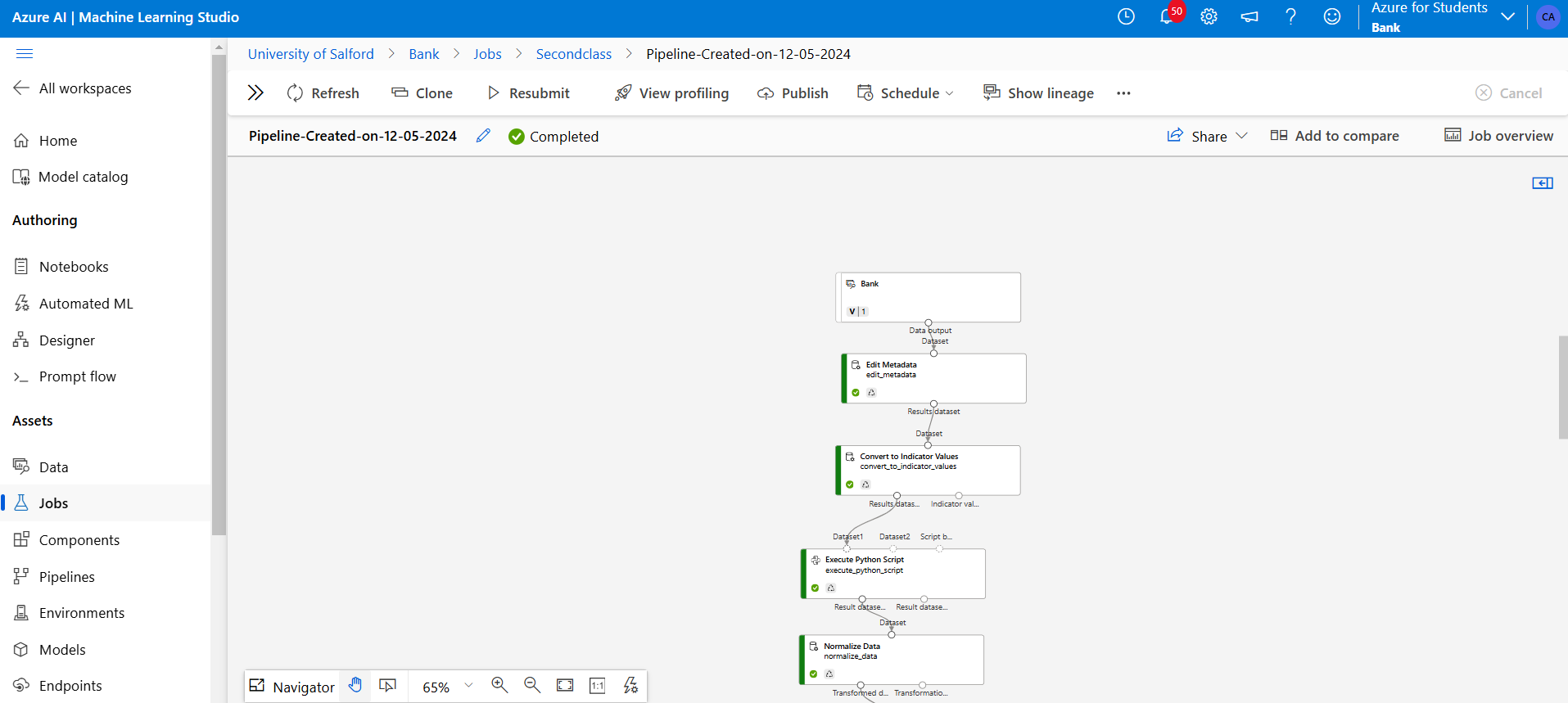

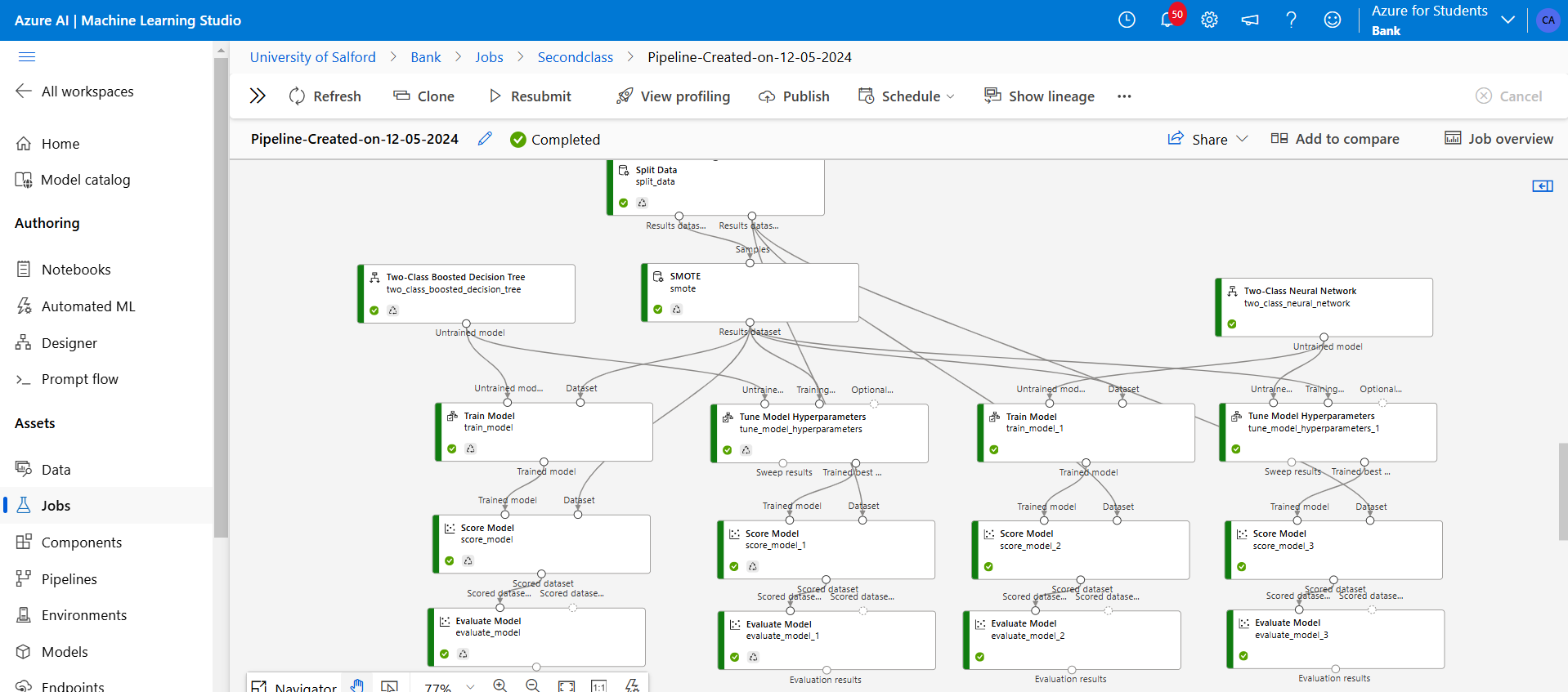

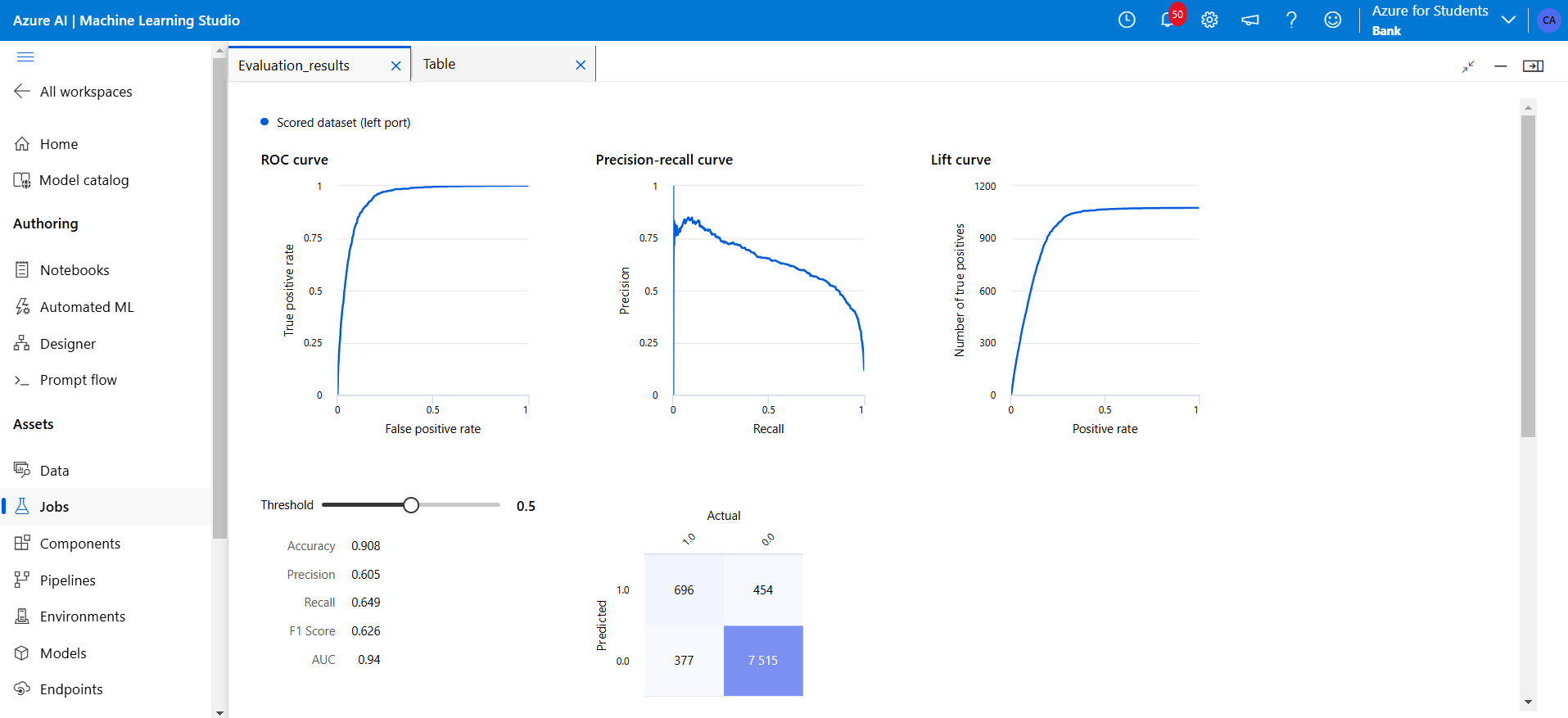

3️⃣ Azure ML Boosted Decision Tree

- AUC: 0.94

- Accuracy: 90.8%

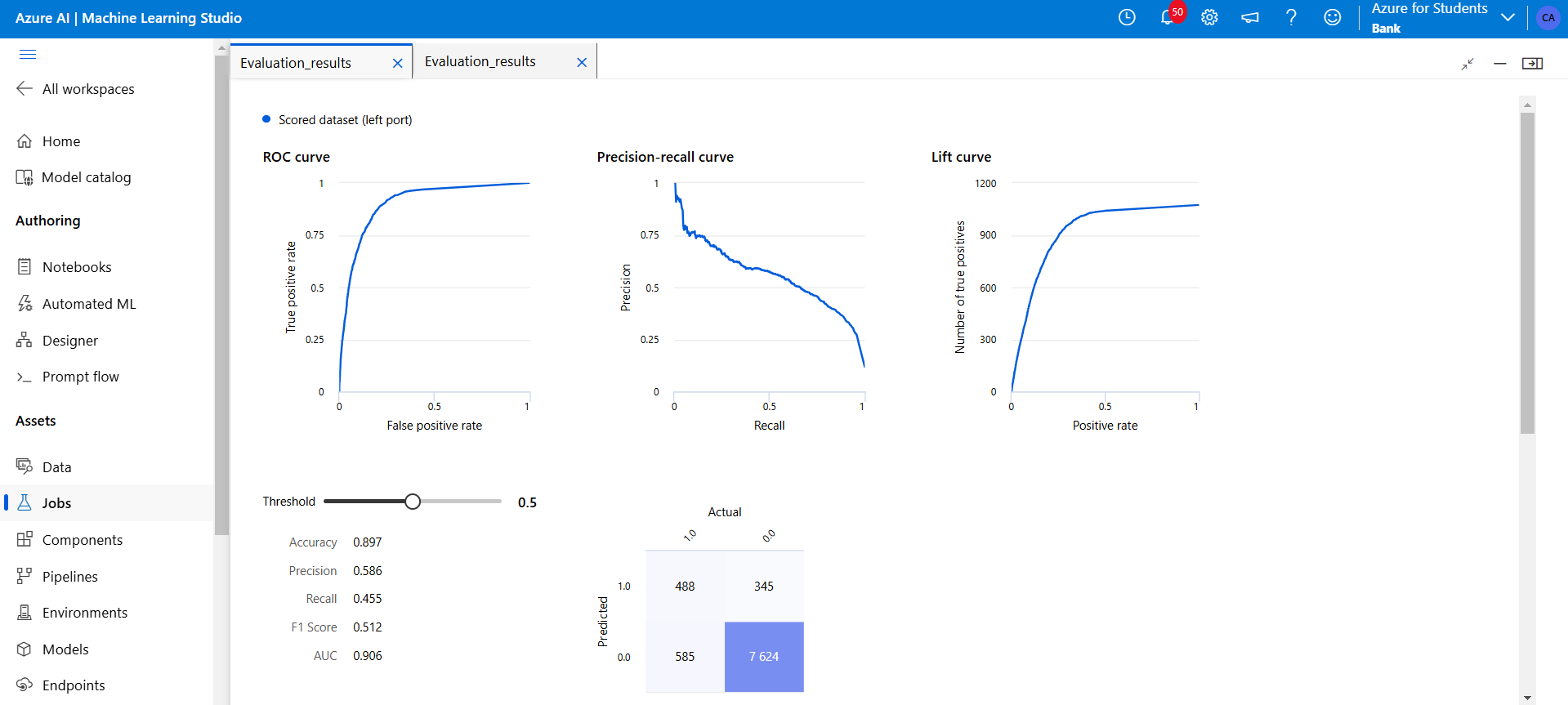

4️⃣ Azure ML Neural Network

- AUC: 0.906

- Accuracy: 89.7%

Figure 15: Dataset upload into Azure table and visualisation

Figure 15: Dataset upload into Azure table and visualisation

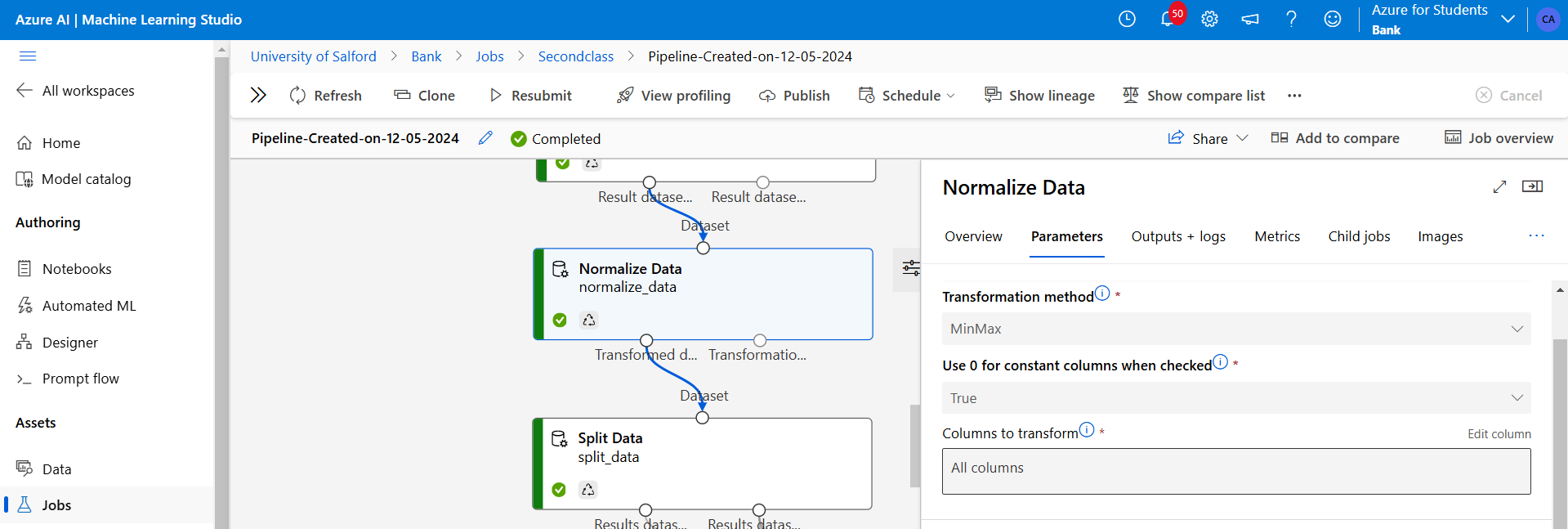

Figure 16: Using Execute-Python-Script was used to convert the categorical target variables from (yes to 1 and no to 0).

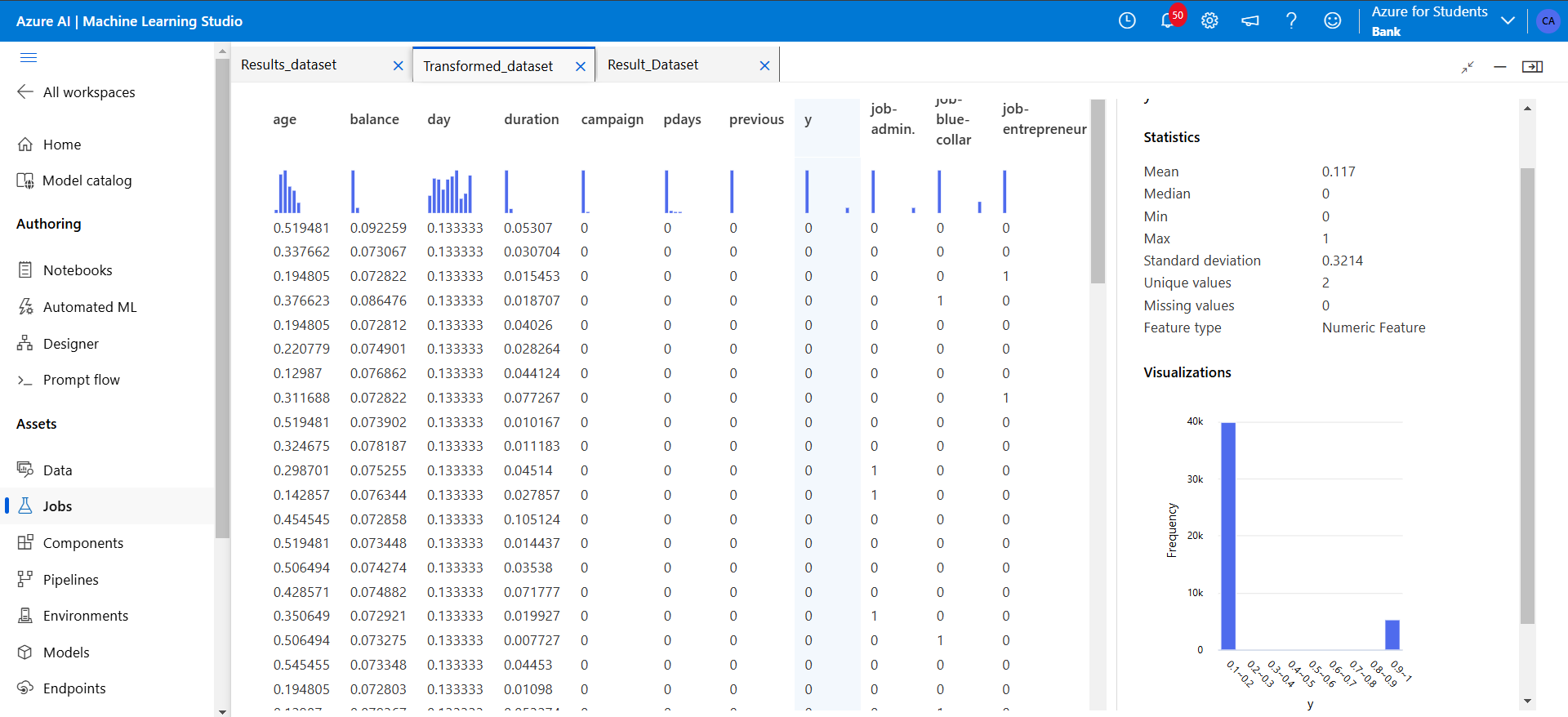

Figure 17: Using the normalise data module above to scale the dataset using MinMax scaler method.

Figure 18: Next above, is shown the imbalanced class label “y” where 1 is highly dominated by 0.

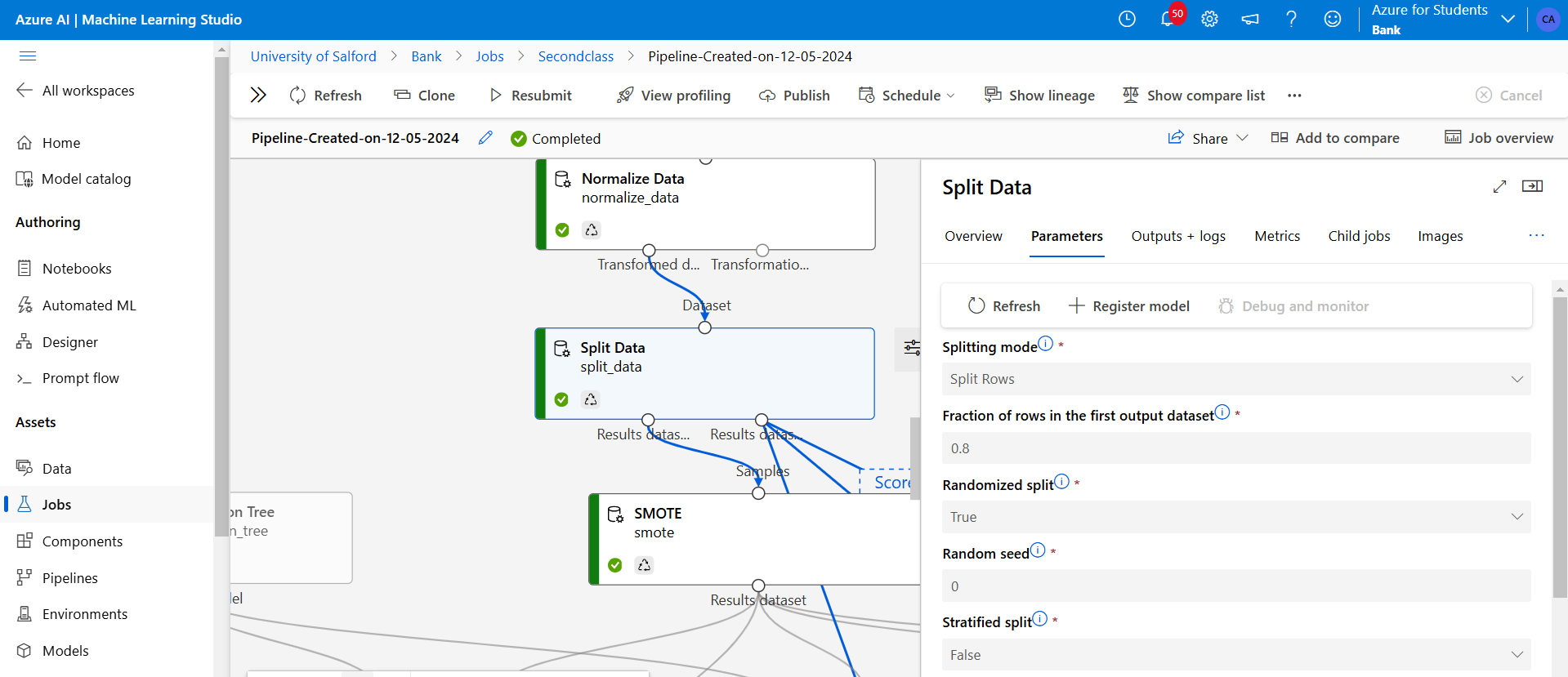

Figure 19: Next above, I split the result into 80% training and 20% testing and then I carried out SMOTE to improve the balancing of “y” also known as subscription.

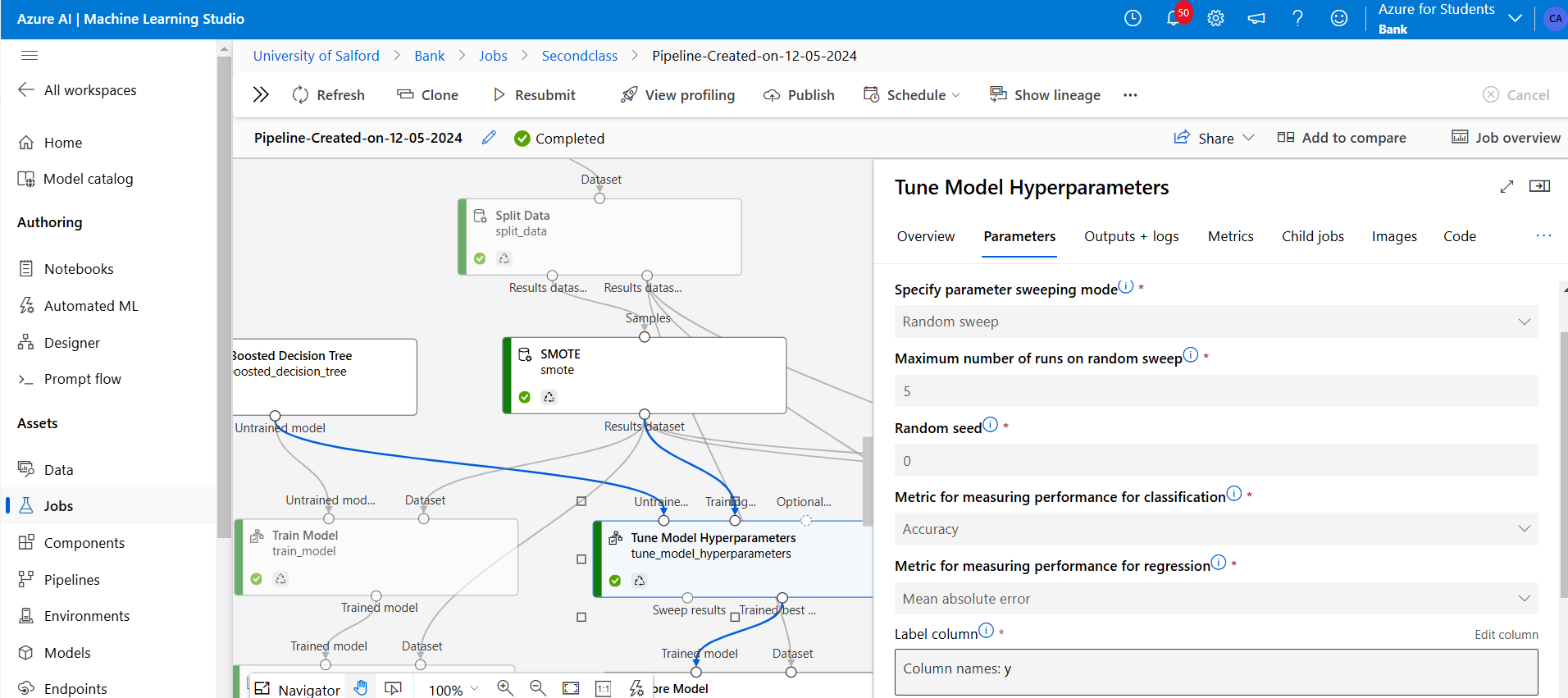

Figure 20: Also above I have attached my Two-class-boosted Decision Tree to Tune Model Hyperparameters which trained the tuned version of the model, then it would output the most efficient combination by accuracy, and compared to base model.

Figure 21: The Score model follows and the Evaluate model are added to generate and analyse model performance.

Figure 21: The Score model follows and the Evaluate model are added to generate and analyse model performance.

📊 ROC Curve Visual

Figure 22: This shows the Two Class Boosted Decision Tree Report

Figure 22: This shows the Two Class Boosted Decision Tree Report

Figure 23: This shows the Two-Class Neural Network.

Figure 23: This shows the Two-Class Neural Network.